Packaging Industry Outlook: Challenges, Trends, and the Role of Automation

From retail to e-commerce to food and beverage, the packaging and processing industry is under growing pressure to move faster, operate smarter, and manage more SKUs than ever before.

According to PMMI’s 2025 Economic Outlook, demand for packaging and processing equipment remains strong, and the U.S. economy is expected to grow through 2026 despite inflationary risks and labor shortages. Yet, growth brings complexity.

Companies in this space are struggling to ramp up production efficiently, manage rising costs, and maintain inventory accuracy, all while dealing with high turnover and limited floor space.

At the recent PMMI Top to Top Summit, 78% of industry leaders cited productivity as their top priority, followed by cost control and automation, each named by nearly half of the participants. These concerns reflect deeper, structural challenges that are disrupting the way packaging companies handle materials, manage inventory, and plan their operations.

In this blog, we will highlight:

- Key economic trends and challenges shaping the packaging and processing industry in 2025 and beyond

- How these challenges affect inventory management and material handling

- Different types of material handling and automation systems used in packaging operations

- The benefits of adopting smart automation technologies

- How Modula solutions support packaging and processing companies

Key Challenges for Packaging & Processing Companies

From cost inflation to labor gaps and technological disconnects, packaging and processing companies are facing a combination of strategic and operational challenges. These factors don’t just affect production. They have a direct impact on inventory management, material handling, and overall supply chain efficiency

Supply Chain Disruptions and Trade Uncertainty

Shifts in trade policy and rising tariffs are also reshaping global sourcing strategies.

While full reshoring is considered unrealistic for most, many companies are actively working to shorten supply chains and diversify suppliers. This adds complexity to logistics and requires more adaptable inventory systems and warehouse workflows.

Diversifying suppliers, monitoring exposure to tariffs, and managing alternative routes all create ripple effects across inventory planning and material handling operations.

Rising Costs and Inflation Pressures

Material and inventory costs are on the rise. The Producer Price Index (PPI) for packaging materials and industrial inputs is increasing, pushing up the cost of items stored in inventory.

To stay competitive, companies are being urged to adopt long-term inflation strategies. This includes improving forecasting, managing inventory levels more aggressively, and building more cost-effective material handling workflows.

Interruptions in the supply chain also come with a real cost. Recent port labor strikes on the East Coast of the U.S., for example, were estimated to cost the economy $540 million per day, highlighting the vulnerability of material flows and the need for better contingency planning.

In response, more companies are moving away from decisions based solely on upfront cost and instead evaluating solutions through the lens of total cost of ownership (TCO), factoring in energy efficiency, maintenance, and downtime risks across the product lifecycle.

Labor Shortages and Workforce Readiness

One of the most pressing challenges is the lack of skilled labor. Many companies are struggling to find and retain qualified technicians. This is particularly critical when onboarding new equipment or launching new production lines.

According to the 2025 PMMI Economic Outlook, the U.S. labor market remains extremely tight, with nearly one job opening for every unemployed person.

This shortage affects everything from day-to-day operations to long-term planning.

Without proper training, operators may lack the skills to run machines efficiently, troubleshoot issues, or follow standard procedures.

The result is slower ramp-up times, inconsistent performance across shifts, and increased downtime – all of which disrupt material flow and inventory accuracy.

Lead Times, Spare Parts, and Obsolescence

Packaging operations rely on a mix of standard and critical components to stay running.

But with long lead times, limited availability, and unexpected obsolescence, it’s becoming harder to manage spare parts inventories.

In PMMI’s 2024 Aftermarket Parts and Services report, 75% of end users said that delivery delays and part availability were among their biggest concerns. Most companies are stocking critical parts in-house when possible, but it’s not always feasible, especially when managing multiple machines or product lines.

Without quick access to the right parts, even minor breakdowns can lead to extended downtime and missed delivery windows. This creates a ripple effect across the supply chain, impacting everything from production planning to warehouse operations.

Operational Bottlenecks and Internal Inefficiencies

Several internal inefficiencies are creating obstacles in day-to-day operations:

Beyond external supply issues, many companies face significant internal inefficiencies that create bottlenecks in day-to-day operations and directly impact material handling.

Three key areas stand out:

- Machine interfaces (HMI) are another challenge. 66% of operators say current interfaces are not intuitive, leading to errors, longer resolution times, and slower material movement on the production floor.

- Spare parts planning remains a weak point. Even when parts are on-site, poor planning is a critical issue. 28% of companies cite it as a key factor leading to unexpected downtime and production delays.

- Inventory mismatch is a major concern. This is especially true in the CPG sector, where having too much or too little stock can result in lost sales or excessive carrying costs.

From Just-in-Time to Resilience

For years, packaging operations focused on lean processes and just-in-time inventory strategies.

But the disruptions of the past few years, from global pandemics to port closures and labor strikes, have revealed the risks of ultra-lean supply chains.

Today, companies are reevaluating their approach and prioritizing resilience over minimalism. This includes:

- Holding more safety stock of high-risk components

- Diversifying supplier bases to reduce reliance on single sources

- Investing in flexible automation to stay agile when plans shift

The goal is no longer just efficiency. I t’s about building a supply chain that can adapt quickly, absorb shocks, and continue to deliver.

Startup Delays and Integration Gaps

Getting new equipment up and running quickly is essential to staying competitive.

But many companies still experience a drop in performance after installation. This is often because planning, training, and IT-OT integration weren’t addressed early enough.

The 2025 PMMI Top to Top Summit highlighted how vertical startups, where equipment goes from installation to full production without performance dips, are rare but possible.

To achieve them, companies need clear success metrics, early collaboration with OEMs, and well-prepared teams.

Without that, it’s common to see delays, confusion, and system disconnects that affect not just production, but also material movement and inventory visibility.

Technology Integration and the Lack of Standards

IT-OT integration is essential to enabling real-time visibility and control, but it’s still a major challenge.

Many facilities still rely on older machines that don’t interface with modern systems, which limits tracking capabilities and makes inventory data unreliable.

An additional hurdle is the lack of standardized communication protocols between machines from different OEMs.

According to PMMI data, 75% of CPG companies report this as a barrier, integration becomes time-consuming, expensive, and inconsistent across equipment.

Packaging Sector – Specific Operational Pressures

Operational challenges can vary significantly depending on the market segment, but here are a few examples for some specific industries:

- Food manufacturers are operating at nearly full capacity (85%), often with minimal inventory. This leaves little room for errors in internal logistics and restocking.

- Beverage companies, on the other hand, are experiencing slower demand, which presents a different challenge: how to reduce excess inventory and minimize waste while maintaining service levels.

Pharmaceutical companies are seeing strong growth, driven by an aging population and rising healthcare demand. But the sector remains vulnerable to tariff-driven cost increases and supply chain risks tied to international imports. - Medical equipment manufacturers are recovering from a recent slowdown. As demand picks up toward late 2025, they’ll need agile systems that support scalable growth and ensure fast, traceable inventory handling.

The operational impact of these challenges goes beyond production. From volatile supply chains to staffing shortages, each issue leaves a measurable mark on inventory management and material handling practices across packaging and processing facilities.

The result is a growing need for flexibility, real-time visibility, and more intelligent automation to stay competitive.

Challenges in the Packaging Industry: How They Affect Inventory and Material Handling

Here’s how each challenge is affecting operations on the warehouse floor:

Supply Chain Volatility Disrupts Inventory Flow

As companies shift away from Just-in-Time models toward more resilient sourcing strategies, they’re facing unpredictable inventory fluctuations. Late shipments, sudden stockouts, and overstocking are becoming common.

This forces a reactive approach to material handling in the packaging and processing industry, making it harder to plan storage space, schedule replenishment, and maintain throughput.

Warehouse layouts must now accommodate buffer stock, and material handling systems need to adapt quickly to unplanned inventory movements.

Cost Pressures Squeeze Storage and Movement Budgets

With inflation driving up both material and labor costs, the financial burden of storing and moving goods is heavier than ever. Companies are caught between reducing inventory to cut carrying costs and increasing stock to prevent shortages.

This tension challenges warehouse managers to balance inventory optimization with operational risk, especially in high-mix environments like packaging.

At the same time, fewer resources for automation in packaging may delay technology upgrades, pushing teams to extend the use of older systems with higher maintenance needs.

Labor Shortages Lead to Errors and Inefficiencies

The lack of experienced workers means more reliance on temporary or undertrained staff. This affects picking accuracy, increases handling time, and raises the risk of inventory errors.

In environments with high SKU variability, even minor mistakes can lead to costly disruptions in packaging operations.

Without proper support tools, manual processes struggle to keep up. This reinforces the need for warehouse automation to reduce dependency on scarce labor and improve consistency across shifts.

Delays in Spare Parts Ripple Across the Supply Chain

Extended lead times for spare parts and equipment components introduce a hidden but significant challenge. A small part missing from inventory can halt an entire packaging line, leading to missed orders and storage congestion.

To mitigate this risk, companies are increasing MRO inventory and adopting more robust spare parts planning tools. This shift requires smarter inventory management to avoid both downtime and overstock of low-rotation items.

Internal Inefficiencies Multiply Operational Risk

Outdated machine interfaces, poor inventory visibility, and siloed data are holding back warehouse performance. These inefficiencies slow down material flow, lead to double handling, and create mismatches between stock levels and real-time needs.

For companies operating across multiple production lines or facilities, centralized visibility is essential. Modern automation solutions for packaging and processing are key to overcoming fragmented workflows and improving responsiveness.

Building Resilience Requires Physical and Digital Flexibility

The move away from lean strategies in favor of resilience means companies are holding more safety stock, sourcing from multiple suppliers, and preparing for disruption.

But this resilience comes at a cost: more space required, more complex inventory rotation (e.g. FIFO), and tighter control over shelf life and batch tracking.

Material handling systems must support dynamic storage strategies and offer the flexibility to handle fluctuations without disrupting daily operations.

Slow Startups Strain Inventory Coordination

When new machines or lines don’t ramp up as planned, inventory and materials prepared for those operations can sit idle. This leads to wasted space, capital lockup, and last-minute rescheduling of picking and restocking workflows.

A successful packaging operation requires not just the right equipment, but also clear startup planning and seamless integration with inventory management

Poor Technology Integration Reduces Visibility

When systems don’t communicate, real-time inventory tracking becomes unreliable.

Without proper integration between warehouse management software and production data, teams are forced to make decisions based on outdated stock levels or inaccurate location information.

This lack of visibility leads to delays in replenishment, missed picks, and errors in order fulfillment.

For companies planning to introduce automation in their packaging and processing operations, whether conveyors, picking systems, or robotic solutions, seamless system integration is essential to ensure performance, accuracy, and scalability.

Sector-Specific Pressures in the Food & Beverage, Pharma & Medical Industry

Operational pressures can differ widely depending on the market. Food & beverage, pharma, and medical equipment are good examples of that contrast.

Food manufacturers are running at nearly full capacity – around 85% – with very limited inventory buffers. This makes internal logistics and restocking extremely sensitive. A small delay or error in material handling can quickly lead to production bottlenecks or stockouts.

On the flip side, beverage companies are facing slower demand. Their challenge is the opposite: managing excess inventory and minimizing waste while still maintaining high service levels.

In both cases, inventory management and material handling processes must be carefully calibrated to balance efficiency with responsiveness.

The pharmaceutical industry is experiencing strong growth, partly driven by an aging population and sustained healthcare demand. This puts pressure on inventory systems to be highly accurate, traceable, and compliant with strict regulatory standards.

Raw materials, active ingredients, and finished products must be stored in secure, clean, and sometimes temperature-controlled environments – adding complexity to material handling.

Medical equipment manufacturers are in a recovery phase, with growth expected to pick up toward the end of 2025.

As volumes rise, they need flexible systems that can scale quickly and ensure fast, error-free picking, especially for high-mix, low-volume components used in customized medical devices.

| INDUSTRY CHALLENGE | IMPACT ON INVENTORY & MATERIAL HANDLING |

| Supply Chain Disruptions & Trade Uncertainty | Fluctuating stock levels, emergency shipments, and chaotic material flows |

| Rising Costs & Inflation | Pressure to reduce stock, higher carrying costs, and delayed upgrades to material handling systems |

| Labor Shortages & Skills Gaps | More picking errors, slower handling, and reduced throughput |

| Spare Parts Delays & Obsolescence | More downtime, need for larger spare part inventories, and higher storage space requirements |

| Internal Bottlenecks & Inefficiencies | Slower workflows, inventory mismatches, and more handling errors |

| From Efficiency to Resilience | Increased demand for smart storage solutions and efficient stock rotation |

| Equipment Startup Delays | Wasted space, tied-up capital, and disrupted warehouse planning |

| Poor Technology Integration | Inaccurate inventory data and reduced ability to automate processes |

| Segment-Specific Pressures (e.g., Food & Beverage, Pharma & Medical) | Food: little margin for error; Beverages: overstock and waste risk; Pharma: need for traceability & accuracy; Medical: need for agility. |

Essential Material Handling Systems in Modern Packaging Facilities

As the packaging and processing industry adapts to labor shortages, rising costs, and space constraints, automation is becoming a strategic priority.

According to PMMI’s 2025 Economic Outlook and Top to Top Summit, over 50% of companies are actively investing in automation to address workforce gaps and improve operational speed.

Below is a breakdown of the most relevant material handling and automation systems that support packaging operations, whether upstream in processing or downstream in fulfillment and distribution.

Conveyor and Transport Systems

These are essential for moving products between different stages of production and packaging. As PMMI notes, many companies are redesigning their conveyor layouts to support higher throughput and reduce manual handling.

- Belt and Roller Conveyors: Used to move items like bottles, boxes, or totes along the line.

- Mat-Top or Chain Conveyors: Ideal for accumulation and transferring full pallets to wrapping or shipping areas.

- Screw Conveyors (Augers): Commonly used in processing to move powders or granular ingredients in a contained flow.

These systems reduce operator fatigue, lower the risk of product damage, and support continuous material flow – key benefits for facilities running multiple shifts or batch production.

Robotic Automation

PMMI research shows that robotic systems are among the top investments for companies looking to boost uptime and reduce manual tasks.

- Palletizers and Depalletizers: Handle repetitive stacking and unstacking of cases – especially important where speed and ergonomics are critical.

- Pick-and-Place Robots: Useful in both primary and secondary packaging, including placing items into trays or assembling variety packs.

- Case Erectors and Sealers: Streamline end-of-line processes, working alongside robots to improve speed and accuracy.

These systems are particularly effective in managing SKU variability and minimizing errors during high-speed packaging.

Autonomous Transport Systems

With labor availability declining, more companies are integrating mobile robots to automate internal logistics.

- AMRs (Autonomous Mobile Robots): Navigate dynamically and are used to move materials between zones (e.g., from storage to line-side staging).

- AGVs (Automated Guided Vehicles): Follow fixed paths and are ideal for repetitive pallet transfers.

Automated Storage and Retrieval Systems (AS/RS)

The 2024 Aftermarket Parts and Services report highlights rising concerns around spare parts availability and internal logistics. AS/RS help companies store, organize, and retrieve items more efficiently:

- Vertical Lift Modules (VLMs): High-density storage for components like packaging supplies, ingredients, or spare parts.

- Mini-Load AS/RS: Handle trays or totes with high-speed picking for e-commerce or kitting operations.

- Unit-Load Systems: Crane-based systems used for pallet storage in distribution or raw material warehouses.

These systems help reclaim floor space, improve inventory visibility, and support fast replenishment.

They support just-in-time delivery and help bridge gaps in workforce availability without requiring extensive layout changes.

Warehouse Software Systems

The role of software is central to packaging automation. PMMI emphasizes the need for data-driven coordination between systems and teams:

- Warehouse Management System (WMS): Tracks inventory, controls picking and put-away, and provides visibility across operations.

- Warehouse Control System (WCS): Coordinates commands between the WMS and physical equipment in real time.

Together, these platforms provide the intelligence needed to run a high-performing, integrated warehouse, enabling companies to respond to shifts in demand with greater agility.

Benefits of Automation in the Packaging and Processing Industry

As the packaging and processing industry evolves, automation has become a strategic priority – not just to reduce costs, but to build more agile, efficient, and resilient operations.

By integrating automated systems across production and warehouse environments, companies can address key industry challenges while preparing for future growth.

Here are some of the most impactful benefits:

- Labor Optimization and Ergonomic Safety: Automation reduces dependency on manual labor, helping businesses overcome hiring difficulties and rising labor costs. By automating repetitive or physically demanding tasks, companies can reallocate their workforce to higher-value roles, while improving operator safety and reducing strain or injury risks.

- Increased Productivity and Speed: Automated systems support high-speed operations, minimize downtime, and enable continuous material flow. This is essential in environments where packaging lines run at high throughput and demand quick changeovers. Robotics, conveyors, and advanced storage systems help eliminate bottlenecks and increase daily output.

- Accurate Inventory Management: With real-time tracking and precise control over stock levels, automated systems reduce the risk of errors, stockouts, and overstocking. This is especially critical in packaging operations where small parts and components must be managed efficiently to support just-in-time production.

- Better Use of Space: Vertical and high-density storage systems allow companies to reclaim floor space and optimize facility layouts. This is particularly important for manufacturers operating at or near full capacity, where maximizing available space can delay or eliminate the need for costly expansions.

- Greater Resilience and Flexibility: Automation helps companies adapt quickly to supply chain disruptions and demand fluctuations. By streamlining internal logistics and enabling modular, scalable operations, businesses can respond faster to changes and maintain continuity even in uncertain conditions..

- Enhanced Data and Process Integration: Modern automation systems are integrated with warehouse software (WMS/WCS), providing better visibility across departments and enabling data-driven decisions. This connectivity is key to unlocking smarter workflows, predictive maintenance, and synchronized production planning.

How Modula Helps Packaging and Processing Companies Overcome These Challenges

Once the benefits of automation are clear, the next step is choosing a solution that can actually deliver results – quickly, reliably, and without disrupting operations. That’s where Modula systems come in.

Whether you’re dealing with labor shortages, space constraints, inventory complexity, or the need for tighter system integration, Modula offers practical, scalable solutions tailored to the packaging and processing industry.

Optimize Space in Any Facility Layout

Modula Vertical Lift modules (VLMs) help reclaim floor space by storing vertically (up to 52 feet) and consolidating inventory into a much smaller footprint. Compared to traditional shelving, this can free up to 90% of floor space. In lower-ceiling environments, the Modula Horizontal Carousel offers a compact, high-speed solution.

For storing heavier or palletized goods, Modula Pallet enables vertical pallet storage directly from ground level, eliminating the need for forklifts and improving safety. The space saved can be repurposed for production equipment, kitting areas, or new packaging lines.

Boost Labor Productivity and Operator Safety

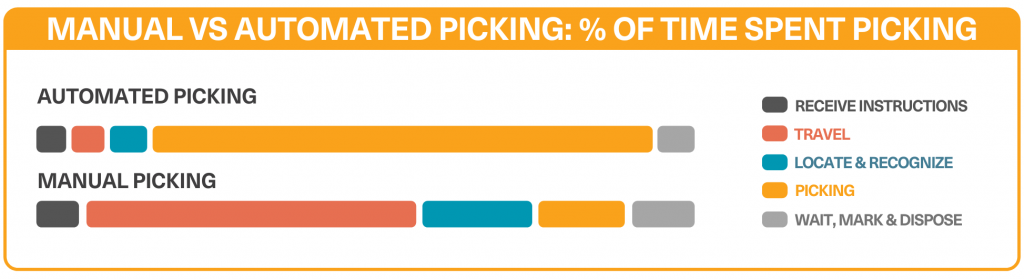

With Modula’s “goods-to-person” systems, operators no longer need to walk across the warehouse to search for parts. Items are delivered directly to an ergonomic access bay, reducing walking time by up to 70%. One operator can handle the work of several, with productivity increases of up to 90%.

Visual picking aids, such as the alphanumeric LED bar and laser pointer, help ensure accuracy, reducing human error and achieving up to 99.9% picking precision. This is especially valuable when handling packaging materials like heavy rolls or awkward cartons.

To further enhance picking speed and accuracy, Modula also offers a full suite of order picking solutions that can integrate with its vertical lift modules and horizontal carousels:

- Modula Put to Light: Designed for fast batch picking, this system uses an OLED display with LED light indicators to guide operators on where to place items. A barcode scanner ensures each action is validated, improving accuracy during high-volume order processing.

- Modula Picking Station: A complete workstation for batch picking and order consolidation, it combines Put to Light technology with scan or touch validation for added reliability.

- Modula Picking App: Allows warehouse staff to manage picking and replenishment via a mobile device, giving operators flexibility to monitor and control operations while on the move.

- Modula Picking Cart: A mobile picking solution with configurable displays, Wi-Fi connectivity, and Put to Light controllers. It supports fast and accurate order fulfillment across multiple bins with battery backup and scan/touch validation.

These solutions are especially effective in packaging and processing environments where order volumes are high and SKU variety is broad, helping teams maintain speed without sacrificing precision.

Increase Picking Speed and Accuracy.

Ensure Fast Access to Spare Parts (MRO)

Machine downtime is costly in fast-paced production. Modula’s vertical systems like Modula Lift or Modula Slim are ideal for storing thousands of small SKUs such as belts, sensors, and other replacement parts.

With quick access from the bay, maintenance teams can retrieve needed parts in seconds, minimizing line stoppages and improving equipment uptime.

Save Space by Going Vertical with Modula VLMs.

Protect Sensitive Inventory with Climate-Controlled Storage

Packaging and processing companies in industries like food, pharma, and healthcare often handle materials that are highly sensitive to temperature changes or contamination.

Modula’s Climate Control & Clean Room solutions provide enclosed environments with controlled humidity, temperature, and air purity – ensuring stored items remain safe, compliant, and stable.

These systems are ideal for storing packaging components such as blister foils, medical trays, or sterilized parts. Their sealed design and access control not only protect inventory but also support traceability and regulatory compliance.

Manage temperature and humidity levels.

Improve Picking Speed with Modular Flexibility

Modula Flexibox is ideal for high-mix, fast-paced environments. It delivers a bin every 20 seconds, making it perfect for on-demand kitting or direct line replenishment. Its small footprint allows installation near the point of use, while background pre-positioning ensures bins are ready as soon as the operator is.

Thanks to its modular design, companies can scale capacity over time without overcommitting to large upfront investments.

Make the most of your warehouse operations.

Enable Advanced Inventory Control and Vending Logic

Modula Next combines vertical storage efficiency with the precision of industrial vending. It’s ideal for tracking controlled items such as cutters, quality tools, or packaging-specific accessories where usage must be limited, logged, and monitored.

Each access is restricted and recorded, helping ensure compliance, reduce overconsumption, and streamline replenishment – all while saving space and improving security.

Discover More About Modula Next

Support End-to-End Automation with Robotics Integration

Modula solutions can be integrated into fully automated flows.

With robotic integrations, including AMRs, robotic arms, and conveyors, companies can automate loading and unloading operations, streamline inbound/outbound logistics, and further reduce reliance on manual handling. This is particularly effective in packaging, where speed and precision are critical for high-volume orders.

For example, a robot can retrieve a bin from a Flexibox or Lift and deliver it directly to a carton-forming or sealing station, creating a smooth, uninterrupted material flow.

Improve Inventory Control and Reduce Costs

Every item stored in a Modula system is tracked in real time using Modula WMS, providing full visibility – what you have, where it’s located, and in what quantity.

This eliminates mismatches and ensures your production line is never waiting on missing components. With secure, traceable access and dynamic tray height optimization, Modula systems help reduce waste, protect sensitive items, and make better use of every cubic inch, ultimately cutting storage and handling costs.

Bridge the IT/OT Gap with Seamless Integration

Modula WMS connects with major ERP systems, like SAP, Oracle, and Microsoft Dynamics, automating the exchange of picking lists, inventory updates, and order status. This allows warehouse operations to stay aligned with sales, purchasing, and production, eliminating silos and ensuring faster, more accurate execution. Complementing this, Modula Web Analytics lets managers monitor usage, energy consumption, and system health remotely, helping drive informed decisions and predictive maintenance.

Building a More Controlled and Resilient Operation

In an operational environment defined by volatility, the most valuable asset is control.

This means having full control over inventory, optimizing the facility’s physical footprint, and securing the ability to meet production targets regardless of external pressures.

The shift from manual processes to an automated, data-driven approach is therefore more than an equipment upgrade. It represents a foundational business strategy for any packaging company.

Adopting intelligent automation allows a business to move beyond addressing today’s labor shortages or space constraints. It is the key to building a more predictable and resilient operation.

One with the stability to master the complexities of the modern packaging industry and the agility to confidently pursue future growth.